Shared scooter schemes suffered a setback yesterday in Paris. I will leave it to others to delve into the merits of the poorly executed referendum or whether the results – with a meagre 7% voter turnout (~100K votes) – are even meaningful in relation to the estimated 400,000 unique users of the modality. My take on scooters in Paris was expressed last month in Zag. However, I do want to point out that this should be a wake up call for the operators to take a more proactive approach in deploying proven measures that address cities’ concerns before finding themselves at the mercy of the ill-informed opinion of a vociferous minority.

Several of the larger shared micromobility operators recently released a set of industry recommendations intended to “ensure cities receive safe and well-managed mobility services that can be sustainably delivered in the long term.”

We at Drover AI would like to humbly submit some recommendations of our own to help guide the process of evaluating, understanding and selecting technologies that will help produce results desired by cities and operators alike. For too long, operators have cried wolf over certain regulatory requirements while conveniently ignoring the fact that those requirements are in place to enforce existing laws which, when flouted, expose cities to unwanted risks and repercussions.

While public sector organisations like NACTO have previously (in 2018) released comprehensive guidelines designed to establish some best practices for cities struggling to regulate and manage nascent scooter deployments, this latest release is, to my knowledge, the first made by five operators joining forces in a common cause. Many of these recommendations are sound and are borne out of the operators’ cumulative experience in numerous cities across the globe, and signal a maturation and newfound solidarity from the VC funded collective. However, part of this experience has long included posturing with respect to technology and specific capabilities – or lack thereof – which is such an integral part of making shared micromobility “safe and well-managed”.

Specifically, in Section 6d of their joint recommendations, the operators allude to an approach focused on outcomes desired rather than specific technologies. I wholeheartedly agree that technology should be in service of specific outcomes, but then cities must be clear on exactly how a technology proposes to deliver on those outcomes. This is where, historically at least, there has been some publicity driven hyperbole and unfulfilled promises that have led to misalignment with cities. A prime example of this is the tender application process, where cities request descriptions of capabilities that will help them produce their desired outcomes. Operators dutifully put their best prose forward with declarations of capabilities and pedigree to meet those expectations. Unfortunately, most cities do not have the technical expertise to separate the signal from the noise and effectively discern what is real from hyperbole, or complete fiction. This is compounded by the fact that the questions posed in the tender language aren’t suited to properly gauging readiness.

The devil, as they say, is in the details and those really only surface in practice. Enter the technology demo that many cities require as part of the tender process, where all of the written promises are meant to spring to life. Sadly, most of these demos also tend to fall short of evaluating performance that might be expected at scale, mainly due to the following:

- They are typically held in a location shared with advanced notice, allowing for operators to prepare a very controlled environment

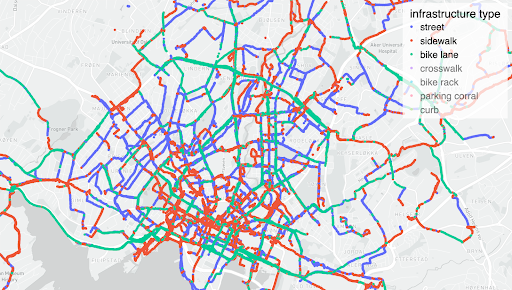

- The location is usually something like an open sky parking lot with none of the actual infrastructure you would see in a city – sidewalks, bike lanes, tall buildings, varied surfaces, and so on. This is akin to evaluating a ship’s seaworthiness in a swimming pool

- Testing in real-world urban settings is sometimes impossible because the behaviour being tested is against the law in those very locations…!

While taking a technology-neutral approach, it is nevertheless important to ask the right questions of any proposed solution to make sure reality doesn’t fall short of expectations. Cities should set specific, measurable performance thresholds for each desired outcome – for example, operators must detect sidewalk riding within three seconds of entering a sidewalk with at least 95% accuracy. Some additional helpful questions to ask include:

- Does the technology require cellular connectivity at all times to function or can it function at the edge?

- Does it require GPS signal availability to function? What happens if that GPS signal is compromised?

- How will it perform in different conditions? Day vs night, seasonal, weather related?

- Does it require additional supporting infrastructure to ensure consistency of performance? Things like RTK base stations to enhance GPS signal strength, for example.

- Does the tech require accurate groundtruth to be available at the outset and maintained over time? Either in the form of accurate GPS mapping or 3D visual mapping?

- Does the tech require extensive data collection prior to launch? And similar data collection over time to maintain performance?

- Is the tech in question available at scale on day one of a deployment?

The industry and technology has evolved at a tremendous pace thanks to significant investments from the private sector, and while the above recommendations will help cities make more informed choices, it’s all meaningless if the cities don’t actively enforce them evenly across the board. For example, in the case of sidewalk detection, if Operator A has invested in a very effective solution that detects sidewalks accurately and even slows vehicles down on them, but Operators B and C have much less reliable tech which is not good enough to take real time action on the speed of a vehicle, then unless the city holds Operators B and C accountable to the requirements, Operator A will find itself effectively bearing a ‘tax’ while also losing ridership because they are the only ones preventing unlawful rider behavior.

Drover AI technology has been successfully deployed across more than 10,000 vehicles over three continents, yet some in the operator ranks still push a narrative that attempts to undermine the technology’s effectiveness. Cities have the unenviable task of enforcing existing laws with new modalities in a rapidly shifting environment filled with countless opinionated stakeholders – I believe the best approach is to bring them solutions that will allow them to embrace shared micromobility while mitigating their concerns about it. Technologies evolve and new solutions arise, but in the meantime, operators should be supportive of the ones that are proven to solve existing problems today. Paris sneezed yesterday; let’s hope the rest of Europe doesn’t catch a cold!